Summarizing the Updated 45L Tax Credit Guidance from the IRS

The IRS recently released some updated guidance on the documentation requirements for the 45L Tax Credit. This update includes necessary clarifications on required documentation and applicable ENERGY STAR and DOE ZERH versions.

In this article, we’ll outline the key points and changes from the update. For more information, you can read the full notice from the IRS here.

Certification:

The updated guidance stipulates that a home must be certified as ENERGY STAR 3.1, ENERGY STAR 3.2, ENERGY STAR Multifamily 1.1, or DOE ZERH in order to qualify for the tax credit. This adds emphasis and clarity that homes must be certified. This eliminates the often manipulated and ambiguous language previously used that said homes must “meet the requirements” of each program. A home certified under a currently effective version of one of the ENERGY STAR program requirements by definition is also certified under any prior version of the same program requirements.

For example, if a home is certified under the ENERGY STAR Single-Family Home Program requirements version 3.2 then it is also certified under the ENERGY STAR Single Family Home Requirements version 3.1.

This same logic applies if a home meets the national requirements. If a home meets the national ENERGY STAR requirements, it is also deemed certified for the regional requirements in the same version. The opposite is true as well, if a home meets the regional program requirements it is deemed to also meet the national version.

This applies to both the single-family and multifamily ENERGY STAR programs.

Documentation:

The older versions of the 45L Tax Credit, prior to the new version released in 2023, required builders to provide an affidavit report in which a rater attested to the home meeting the standards. The updated guidance states that raters no longer need to print those affidavit reports.

Raters do, however, need to provide the correct ENERGY STAR or DOE ZERH certification report to the builder in order for them to claim the tax credit. Builders should then keep these certificates in order to substantiate that they’ve met the requirements of ENERGY STAR or DOE ZERH.

At minimum, builders must retain the following information:

Any Energy Star or ZERH certification

A home dealer’s statement, if applicable, including the following

Name, address and phone number of the manufactured home dealer

Date of the retail sale of the manufactured home

That the dealer delivered the home to a U.S. address

That the home will be used as a residence

Information on any intermediaries between the contractor and the homebuyer

Record to establish

The address of the qualified home

That the taxpayer is an eligible contractor

That the qualified home was acquired from the eligible contractor for use as a residence during the taxable year in which the contractor obtains the credit, unless it is a manufactured home which requires a dealer’s statement

Records indicating that the prevailing wage requirements are met, if applicable

Applicable Versions:

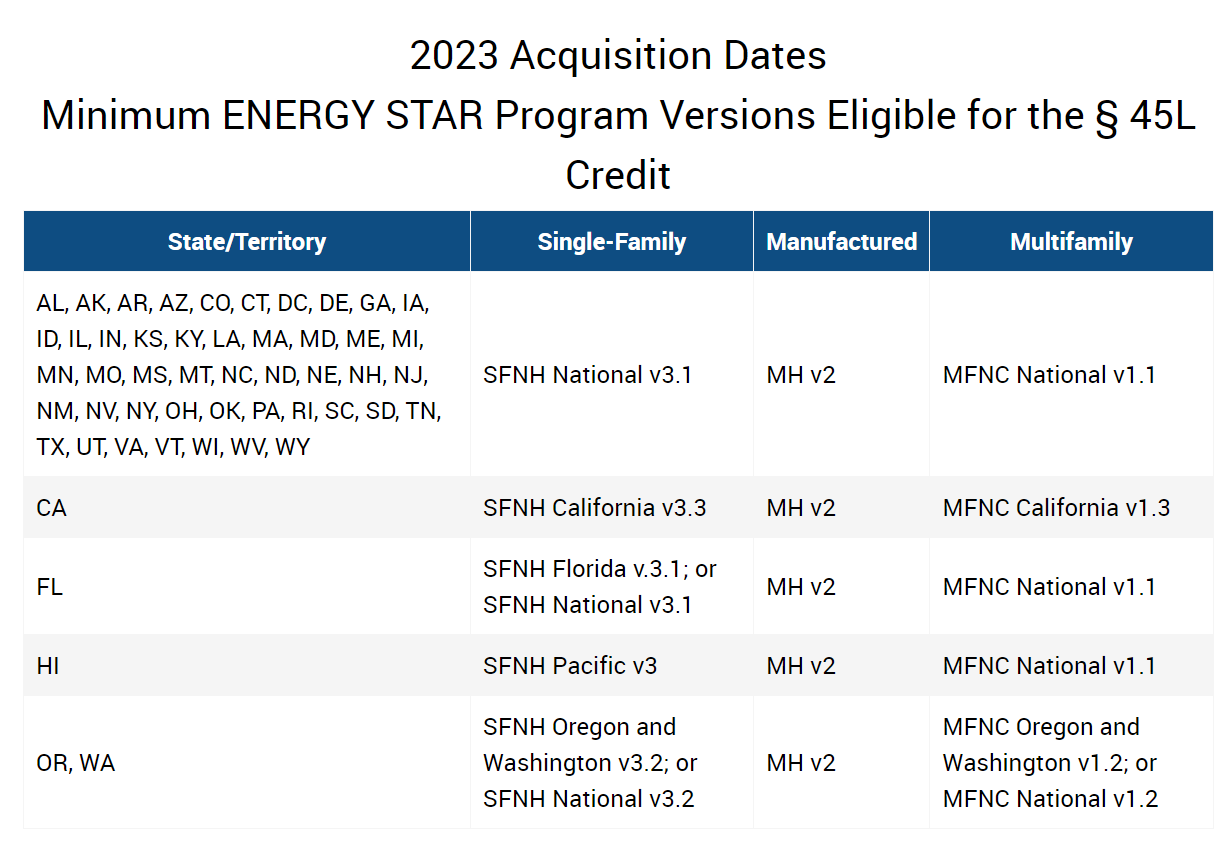

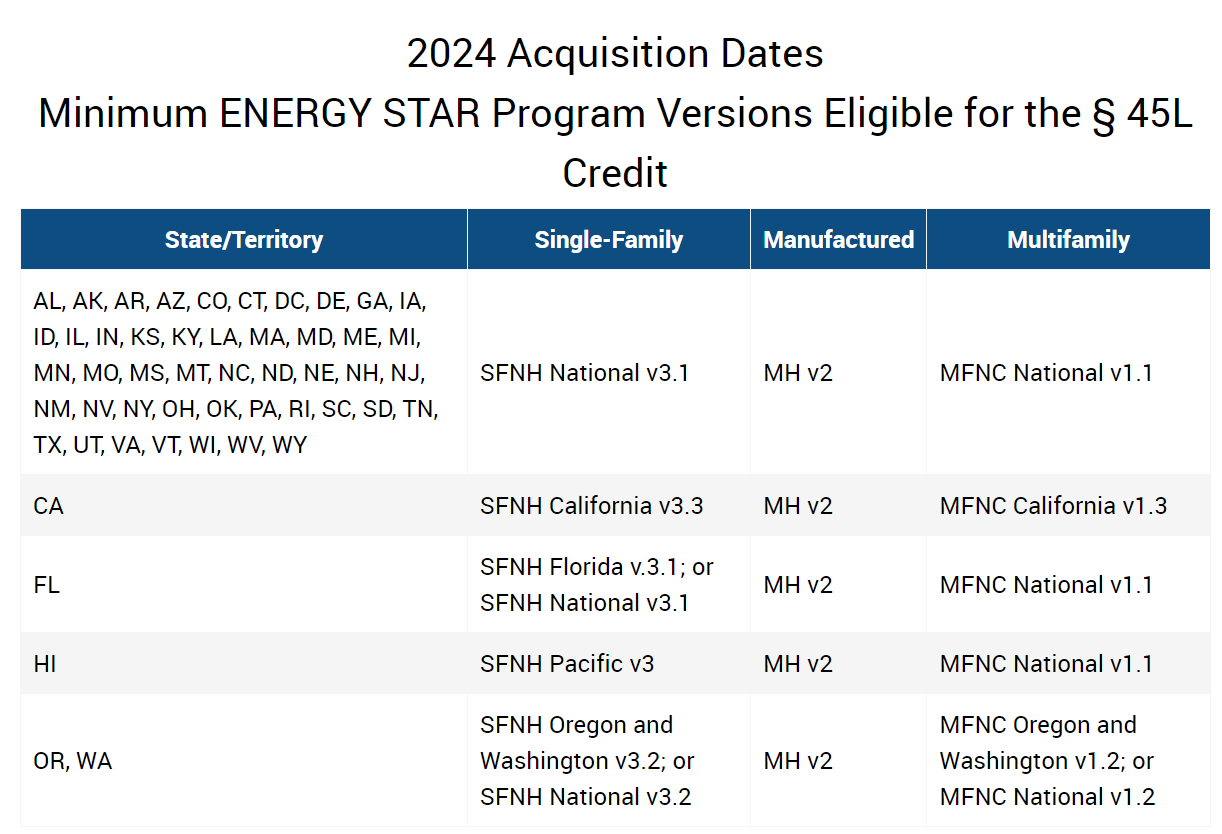

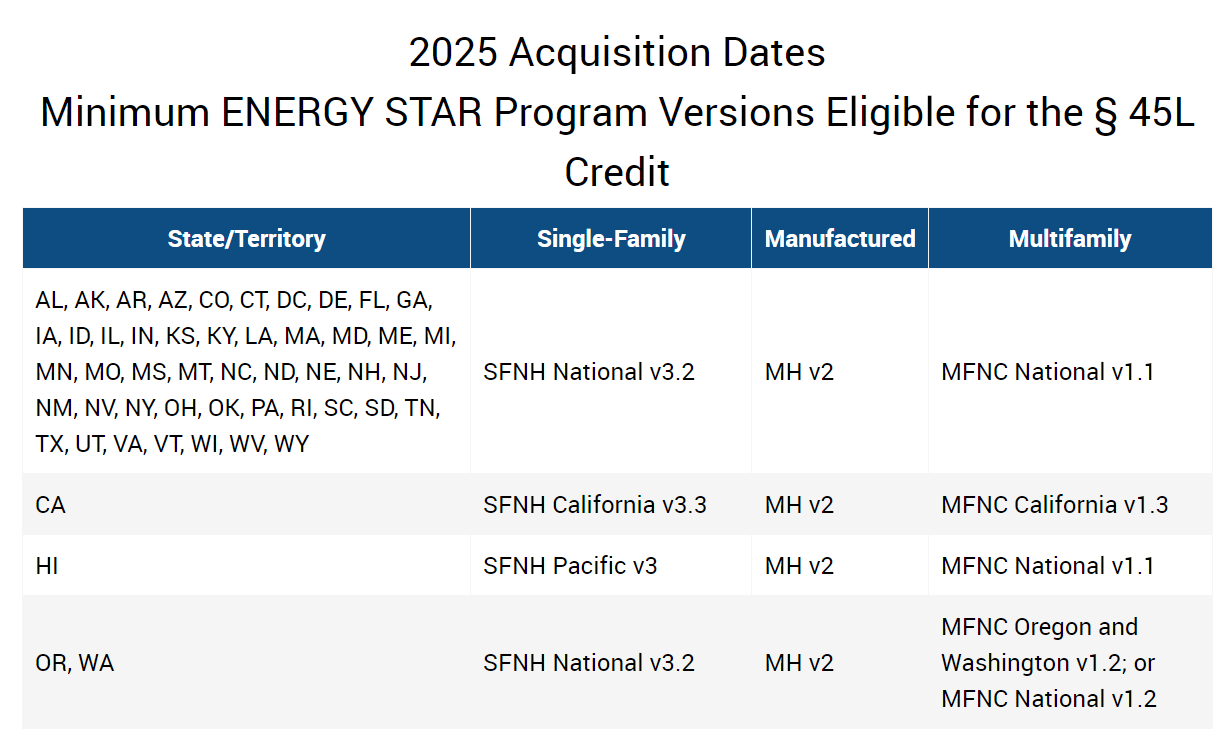

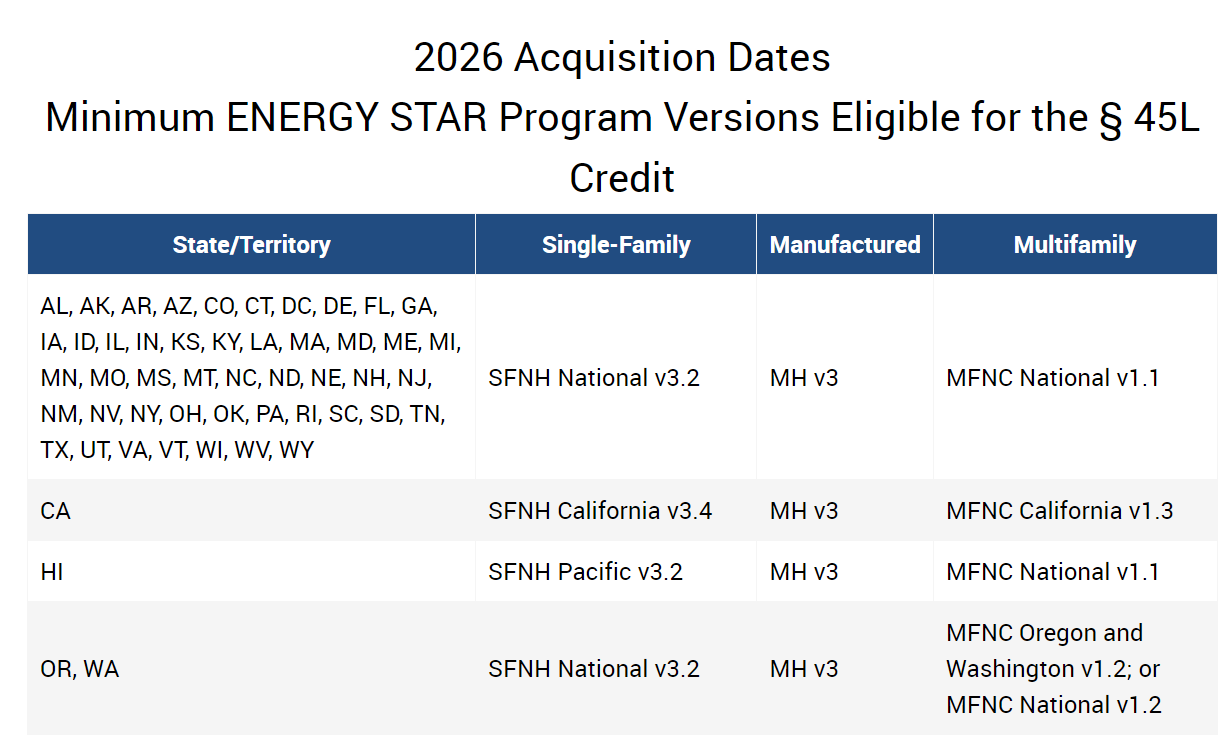

In general, in order to be eligible for the 45L Tax Credit, a home must be certified as either ENERGY STAR Single Family, ENERGY STAR Multifamily, or ENERGY STAR Manufactured Home - whichever is applicable. Alternatively, a home is eligible if it is certified as DOE Zero Energy Ready Home. The particular versions that homes must be certified must correlate with the version in place two years prior to the date that the home is acquired (purchased).

Minimum Applicable ENERGY STAR Program Versions Eligible for the 45L Tax Credit by Acquisition Date:

* For the multifamily sector, eligible versions are determined for acquisition dates through 2026 because the applicable lookback clause in § 45L(c)(3) specifies the version in effect “three calendar years prior to the date the dwelling was acquired.” In contrast, because § 45L(c)(2) specifies a two-year lookback for the single-family and manufactured home sectors, the eligible versions applicable to 2026 acquisitions in those sectors will be determined on/after January 1, 2024. (Source)

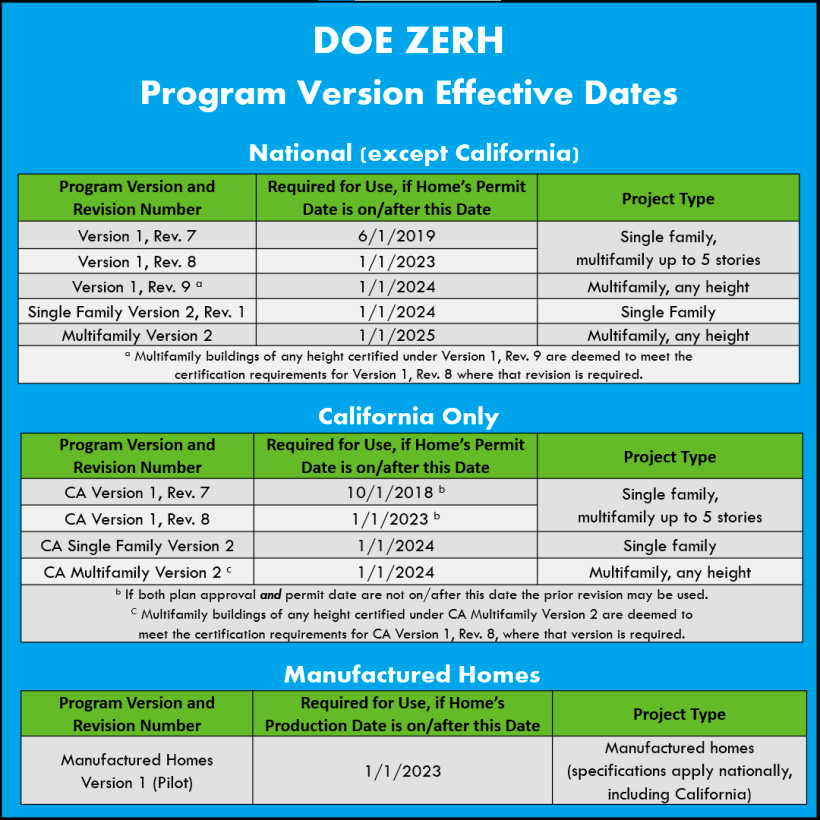

DOE ZERH Minimum Applicable Version Effective Dates:

More information on the ENERGY STAR minimum effective dates is available here. You can also find more information on the DOE ZERH effective dates here.

How Ekotrope Can Help:

Ekotrope is proud to be the number one software provider for ENERGY STAR and DOE ZERH certification. We’re committed to empowering people with technology and insights to drive informed decisions that move our built environment toward sustainability.

Toward that end, our team puts together quarterly educational webinars, The State of the Industry Update, that aim to shed light on some of the challenges and opportunities in the market. We recently hosted a session on the topic of Closing the 45L Compliance Gap where we talked about the drop in 45L compliance in 2023, the reasons behind the drop, and some strategies to help your builders get homes over the hump.

We also publish monthly articles highlighting various updates and trends in the HERS new construction industry. For more information on the basics of the 45L Tax Credit, you can check out this article.

Raters:

Ekotrope’s rating partners have a lot of success with our Scenario Modeling tool. This tool allows you to analyze the impact that various design changes will have on your builder’s projects. Contact us to learn more about how you can take advantage of this tool to plan your builders’ pathways to ensure that they earn the tax credit.

Due to the tardiness of this rule, raters may have hundreds or thousands of ENERGY STAR certificates to print. Sometimes builders want all 45L documentation in one report package. Ekotrope can support raters meeting their builders needs by delivering custom packages of reports to raters to avoid the headache of downloading hundreds of reports by hand.

To aid you further in this process, Ekotrope has developed a new tool, Reports API, which allows you to set up a system that manages all report delivery needs automatically. You can learn more about Reports API and our other time-saving integrations here.

Builders:

As the incentive and rebate landscape becomes increasingly complex, it’s more important than ever for builders to have the ability to accurately track and forecast their incentive earnings on HERS-rated homes.

Ekotrope helps builders derive the maximum value from their HERS-rated homes by enabling you to have full visibility into your HERS-rating data. We want to ensure that if you’re making the effort to build more sustainably, you’re reaping the benefits. Contact us today to learn more about how you can maximize your incentive capture without adding more overhead.

Product Manufacturers:

The 45L Tax Credit represents a massive opportunity for building product manufacturers. Understanding the impact that the use of your product can have on a home’s ability to meet the tax credit requirements can transform your marketing and sales efforts.

We provide product manufacturers with the data and insight that you need in order to determine which regions, cities, or even specific builders can benefit from your product. This information allows you to narrow your marketing efforts, strengthen your sales pitch, and, ultimately, grow your market share. Contact us to learn more about how you can leverage these tools.

We hope you found this article helpful. If you have any questions regarding the 45L Tax Credit, the updated guidance, or how Ekotrope can help, please contact us at info@ekotrope.com.